Banks and banking in Canada; The Best Banking Solutions for Immigrants in 2024

Banks are really important in Canada’s financial world. They’re found all over, from busy cities to quiet towns, and they help the country’s monetary system work well. These banks offer different money services like savings, loans, and investments, which help people and businesses manage their finances. This intro gives you a peek into why banks and banking matter a lot in Canada.

Key takeaway

- Canada welcomes anyone or any group that wishes to open a safe and reliable bank account.

- Canada’s banking services cater to diverse financial needs, offering easy access to funds, investment growth, and borrowing options.

- Canada has one of the most accessible banking systems in the world

- Opening a bank account in Canada is straightforward and there are many options available to you.

- When choosing a bank, consider the balance requirements, ATM limits, cheque fees, monthly charges, interest rates, remittance costs, and opening offers to find the best fit for your financial needs.

- In Canada, investors can opt for either low-risk or high-risk investments, based on their investment objectives and risk appetite.

Table of Contents

Banks and banking in Canada

Providing an overview of banking regulation, this guide aims to give you an insight into the governance and supervision of banks. When we take out a mortgage or a car loan, purchase insurance, or save for retirement, the financial system of banks plays a vital role. It allows businesses to access working capital and invest in growth. Payments can be made safely and quickly through it, which helps manage risks.

A Brief History of Banking in Canada: From Fur Trade to Modern Day

Between the early 17th and late 19th centuries, the fur trade flourished across Canada. The purpose of the fur trade was to satisfy European demands for felt hats. Fur trade led to the exploration and settlement of this continent by creating a highly competitive trade environment. Finally, in 1817, the Bank of Montreal was founded, and the local banking system began business.

Early banking in Canada: The role of the fur trade

For nearly 250 years, the fur trade flourished across the vast, forested Canadian wilderness. It peaked between the early 17th and late 19th centuries. The primary source of this commercial enterprise was trapping beavers to satisfy the demand for felt hats made by Europeans. The intense competition in trade motivated Europeans to travel more and open up the continent for settlement. This led to funding missionary work, establishing relationships between Indigenous people and the economy, and creating Canada.

The emergence of chartered banks in the 19th century

In 1817, the Bank of Montreal was founded. This ushered in a new era of banking in Canada. It phased out colonial practices and launched a more efficient system. However, the establishment of additional banks needed to be approved by the government before they could start operations. A few banks opened branches in different places before the 1930s Great Depression and worked well.

The role of the Bank of Canada in monetary policy

Depending on how the Bank of Canada manages its balance sheet and supplies liquidity to the payment system, the Bank of Canada implements monetary policy by affecting short-term interest rates through one of two alternative frameworks.

Banking in Canada in the 20th century: Consolidation and deregulation

Before the 20th century, the number of banks was restricted by the interests of legislators and high capital requirements. In 1901, Westerners attempted to establish their own banks, and as a result, several dominant banks with many branches were established in Canada.

The banking system was consolidated and deregulated in the 20th century.

According to consolidation, banks were permitted to operate in multiple states and technology-enabled banking institutions were permitted to provide services at lower costs.

According to deregulation, banks could decide how to use and allocate their capital. So, banks and other financial institutions were allowed to invest their money into securities and compete with international competitors.

The current state of banking in Canada

Today, the banking system in Canada is one of the most reliable and strongest systems that operates as an extension of the federal government. Even if you`re not a Canadian citizen or you are one but currently living in another country, you can open a Canadian bank account. Several banks in Canada offer special accounts for newcomers. With all accounts, you can deposit and withdraw money, while some allow you to write cheques, make purchases, transactions, and bill payments.

The Canadian Banking System: How it Works and Who Regulates it

In Canada, banking is regulated by the federal government through the Office of the Superintendent of Financial Institutions (OSFI). Banks in Canada also operate under the Bank Act of Canada, which sets out the rules and regulations that banks must follow. It also outlines the responsibilities of the Bank of Canada, which is the country’s central bank and regulates the money supply.

Banks must also comply with provincial and territorial laws, which can vary from province to province. When it comes to banking, Canada has a highly regulated financial system that is designed to protect consumers and ensure the stability of the financial system.

Types of banks in Canada: Schedule I and Schedule II banks

Generally, there are 3 types of banks in Canada:

- Schedule I banks: Domestic banks like the National Bank of Canada and the Royal Bank.

- Schedule II banks: Subsidiaries of foreign banks like TD, Royal Bank, the Bank of Montreal, Scotiabank, CIBC, and the National Bank.

- Schedule III banks: Branches of foreign banks like Bank of America and Capital One.

The role of the Office of the Superintendent of Financial Institutions (OSFI)

Office of the Superintendent of Financial Institutions (OSFI), regulates the banking system in Canada. OSFI sets the minimum standards for banks, trust and loan companies and insurance companies, and ensures that all of these entities are meeting their obligations to customers and to the public.

Deposit insurance in Canada: The Canada Deposit Insurance Corporation (CDIC)

The Canada Deposit Insurance Corporation (CDIC) is a Canadian Crown corporation that provides deposit insurance up to a maximum of $100,000 per eligible deposit. The CDIC is created to protect Canadians from the loss of their deposits in the event of a member institution failure.

The CDIC insures all types of deposits, including chequing and savings accounts, money orders, drafts, and guaranteed investment certificates (GICs), as long as the deposit is in a member institution. The CDIC is backed by the Government of Canada and is funded by premiums paid by member institutions. The CDIC also provides information and education to the public about the importance of deposit insurance.

The role of the Financial Consumer Agency of Canada (FCAC)

The rights and interests of consumers of financial services are protected by The Financial Consumer Agency of Canada. Banks are supervised by this agency, and financial literacy is strengthened among Canadians through its initiatives.

Anti-money laundering and counter-terrorist financing regulations

The AML/CTF Act was created in close consultation with industry stakeholders from 2004 to 2006. This act regulates financial, gambling, remittance, and bullion sectors that provide designated services.

When illegal sources of money or assets are disguised, anti-money laundering processes can be helpful. Laundered funds are used by criminal organizations to fund corruption, fraud, human trafficking, and drug trafficking.

Money laundering is the process of turning illegal money earned through criminal means into clean money that can be used for legitimate purposes. Money laundering almost always results from committing one of the following crimes: financing terrorism, or financing profitable crimes. Alternatively, terrorism financing refers to an illegal action planned for the future; this is not done for the purpose of collecting, profiting or accumulating.

Choosing a Bank in Canada: How to Compare Options and Find the Best Fit

Choosing the most suitable bank for you depends on a number of factors. These include the type of services you require (such as loans, investments, and other banking services), the fees associated with those services, the convenience of the bank’s location, the quality of customer service, the technology available (for online banking), and the reputation of the bank.

Once you have identified your needs, you can compare banks to find the one that best meets your requirements. It is also important to check the financial stability of the bank and make sure that it is a member of the Canada Deposit Insurance Corporation (CDIC). This will ensure that your deposits are protected up to a maximum of $100,000. Here is a guide that helps you to choose the most appropriate bank in Canada.

Factors to consider when choosing a bank

Here are some important factors to consider before choosing a bank in Canada:

- Monthly and extra service fees

- The highest interest rate

- Having physical locations

- Customer services

- The way they treat you

- Strong online banking system

- The bank’s security track record

- Insurance

- Minimum deposit requirements

- ATM network

- Mobile app features

- Convenience of a bank branch

- Credit unions

- Supporting your lifestyle

- Digital features

- Terms and conditions

- Positive reviews for the bank

Comparison of different types of banks: Big banks, credit unions, online-only banks

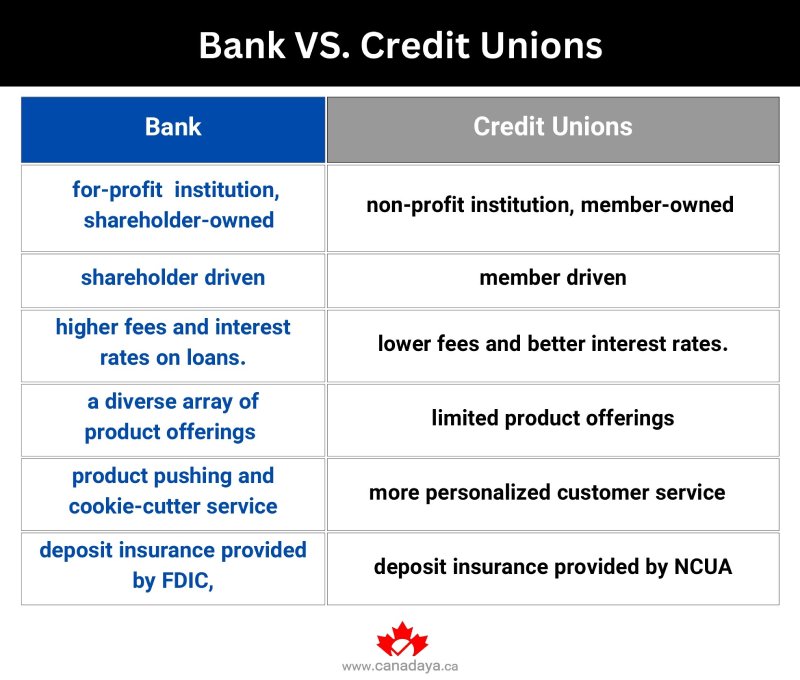

Banks are usually for-profit institutions and the profits they make belong to their members, while credit unions are not-for-profit. But both banks and credit unions offer financial products like certificates of deposit (CDs) and saving accounts.

The main difference between online-only banks and other banks is that you have to open a bank account online in online-only banks and there is no option for you to go to a branch to open an account. But in other banks, you have 2 options for opening an account, including online and through bank branches.

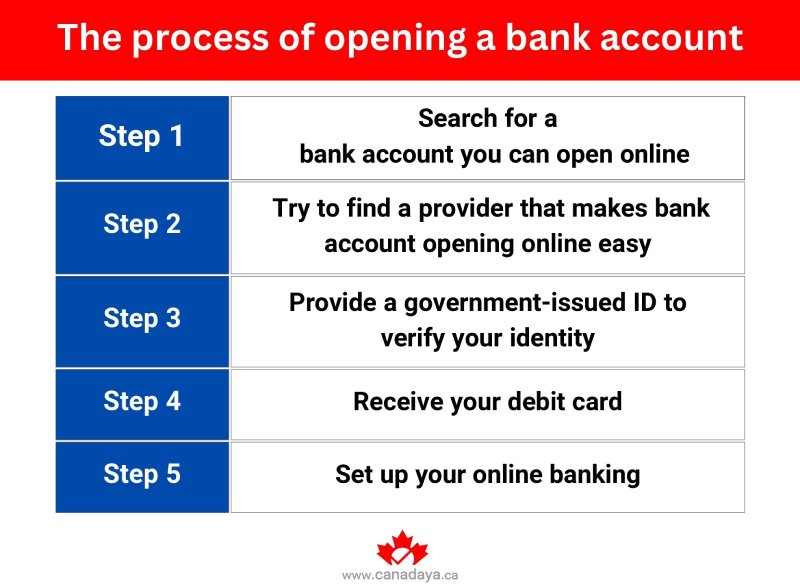

How to open a bank account in Canada

Opening a bank account in Canada is relatively straightforward. You will need to provide valid identification, such as a passport or driver’s license, and you will likely have to provide proof of address. You will also need to fill out a form to open the account. Depending on the bank, you may need to make an initial deposit or provide a minimum balance. Additionally, you should research the different types of accounts available and make sure that the account you choose meets your needs. Once you have all the necessary documents and information, you can visit the bank to open an account.

Bank switching and closing an account

To close an account in Canada, you must contact the bank and ask them to close your account. Not to mention, your bank account will not close on its own and you need to get in touch with them. A closing fee and some identification may be required to close an account. Ask the bank to provide you with a document stating that you have closed your account with the specified bank.

If you want to switch banks, you`ll have to start fresh. Appropriate identification must be presented to prove your identity. Your driver`s license or provincial health insurance card are two types of identification that you need to bring when opening a new account.

How to find the best account for your needs

To find the best bank account for your needs, avoid small ATM networks that do not reimburse out-of-network ATM fees. Also, you can find accounts that have no monthly maintenance fees. Some accounts have a lenient overdraft policy. Accounts such as these can be a smart choice. Another option you should consider before opening an account is interest rates. Rates of 1% or higher for saving accounts are a reasonable option.

Banking Services and Fees in Canada: Understanding the Costs and Benefits

The fees for opening a bank account includes bank fees and charges. There is usually a monthly fee for a bundle of services if you have a dedicated bank account with a financial institution. A limited number of transactions are offered and everything is not necessarily free.

In Canada, around 2.5% – 3% per transaction is charged by banks when you make a purchase using your credit card in another country. Making online purchases in a different currency is also considered a transaction.

Continue reading to learn more about bank fees and services in Canada.

common banking services

In Canada, the most common banking services are:

- Checking accounts: Checking accounts typically allow customers to access their funds through ATMs, online banking, and in-person services.

- Savings accounts: Savings accounts allow customers to earn interest on their savings, and often come with different types of accounts with various benefits.

- Loans and Mortgages: Loans and mortgages are offered by banks to finance purchases and investments.

- Lines of credit: Lines of credit allow customers to borrow money against the value of their property.

- Investment services: Investment services offer customers the ability to manage their investments and diversify their portfolios.

- Debit cards: Finally, debit cards allow customers to access their funds more easily and conveniently.

Bank fees in Canada

Here, you can learn about the most common bank fees and charges in Canada:

- Monthly fee: This is the most common bank fee in Canada. You must pay a monthly fee to hold an account and the amount of the monthly fee depends on your account type.

- Transaction fees: A transaction is made when you make a withdrawal from your account. When the number of transactions exceeds a monthly limit, you’ll be charged a fee of $1-1.50 for each additional transaction.

- INTERAC e-Transfers: This is a standard transaction. Some financial institutions count them separately. As a result, they charge you $1-2 for each one.

- ATM Withdrawal: There is no fee if you use ATMs within your financial institution’s network. But using an ATM from another network, you’ll be charged $1.50-3 each time.

- Paper statement fees: Every month, you’ll have to pay $2-5 to get your monthly statements delivered to your home. However, e-statements are free.

- Non-sufficient Funds (NSF) Fee: If you need to charge an amount that exceeds your account deposit, NSF Fees happen. For instance, charging 100$ when there’s only $60 in your account will cost you about $40-50.

- Overdraft protection: This kind of bank fee is optional and protects you from paying NSF fees. It costs 5$ a month.

You will be charged for physical checks, bank drafts, a safety deposit box and currency exchange services if you need them. These are the most common fees charged by Canadian banks. However, there are a few additional fees.

Online and Mobile Banking in Canada: How to Manage Your Money on the Go

Online banking services can be accessed via mobile devices such as a cell phone, tablet, or even a laptop without getting in touch with the bank. Online banking costs less in Canada than in-branch banking services or ATMs. You can check your transactions, pay bills, and transfer money using online banking services. In any case, you don’t need monthly statements anymore.

Setting up online banking and mobile banking

The following steps show you how to start online banking:

- Step 1: Register at a specific financial institution for online banking

- Step 2: Enter your debit card number

- Step 3: Create a username and a password

- Step 4: Read the terms and conditions and then proceed to accept

How to use online banking to manage your accounts

Online banking will come in handy when you want to manage your accounts online and save time. We provide 7 ways that you can use your account online to make your life easier. Let’s dive in:

- Pay your bills whenever you are able, especially when you forget to pay them.

- Make transfers, pay bills, and access your account even at midnight.

- Access your bank statements online and don`t let unnecessary paper clutter your life.

- Skip the lines. You don’t need to stand in line at the bank during the day.

- Monitor all your transactions even in the middle of the month. You can manage your transactions when your debit card is stolen or lost before canceling the card.

- By checking your balances anytime, you can avoid overdraft fees.

- Set up online banking alerts instead of depending on your memory to remind you to pay your bills at a certain time.

How to deposit checks, pay bills, and transfer money online

To deposit checks, pay bills, and transfer money online, you can use your bank’s online banking service. Most banks provide this service, and the process is fairly straightforward.

To deposit a check, you typically need to upload a digital image of the check to your bank’s website or mobile app or use a mobile deposit feature. To pay bills, you can generally go to your bank’s website or app, select the bill you want to pay, enter the amount and payment information, and submit the payment.

To transfer money, you can typically go to your bank’s website or app, select the type of transfer you want to make, enter the recipient’s information, enter the amount, and finalize the transfer.

Security measures for online banking

Here are some safety tips for online banking:

- Create strong passwords that include 8 or more characters and it’s a combination of symbols, numbers, uppercase, and lowercase letters. Your password should be unique too.

- If your bank provides multi-factor authentication, use it.

- Never keep your account logged in. After you`re done with online banking, log out.

- Don’t use online banking on public WIFI networks. Because they`re not necessarily secure.

- Don’t use a shared computer to access your bank account.

- Don`t share personal information like your account number or social security number with your financial institution when you receive a text or email as they are not allowed to ask you.

- Always check your transactions to be aware of unauthorized charges or withdrawals. If you happen notice any unusual activity, report it to your bank immediately.

- Report stolen or lost cards to your bank immediately.

Frequently asked questions about online banking

The most commonly asked questions about online banking are:

- What are the benefits of online banking?

Benefits of online banking include 24/7 access to your accounts, the ability to transfer funds quickly and securely, the ability to pay bills online, and access to online statements and history at all times.

- How secure is online banking?

Online banking is highly secure. Most online banking services use encryption technology to protect your data and other security measures like two-factor authentication.

- What types of transactions can I do online?

You can do many types of transactions online, including transferring money between accounts, paying bills, and setting up direct deposits.

- What do I need to set up an online banking account?

To set up an online banking account, you need a valid ID, proof of address, and other relevant documents.

- How do I transfer money from my online banking account?

To transfer money from your online banking account, you need to log in to your account and select the option to transfer funds. Enter the amount you wish to transfer and the account information of the recipient and your transfer will be completed.

Banking in Canada as an Immigrant: Navigating the System and Opening Accounts

It can be confusing for newcomers to choose the right bank in Canada. Here we will discuss how banking works for immigrants in Canada. We will also provide some suggestions for choosing the best bank. If you`re a newcomer to Canada, continue reading to learn more about banking in Canada for immigrants and newcomers.

What documents are required to open a bank account in Canada as a new immigrant

If you`re a newcomer in Canada, you need either of the following identification documents to open a bank account:

- Your certificate of Canadian citizenship

- your Canadian driver’s license

- Confirmation of your permanent residency (or permanent resident card)

- Your foreign passport

How to transfer money to Canada from other countries

To transfer money to Canada from another country, you will need to use an international money transfer service like Western Union or MoneyGram. The process is relatively simple: you will need to provide the recipient’s information (name, address, and bank account number), the transfer amount, and your payment details. The money transfer service will then transfer the funds to the recipient’s account in Canada. Depending on the service, you may also be able to track your transfer online.

How to access your money when you first arrive in Canada

In Canada, you can receive your payments through bank transfer or cheque. However, choosing to receive your funds through direct deposit will ensure the payment process is faster and more secure. It also makes sure that you never miss a payment in the mail.

How to get a Canadian credit history

To get a Canadian credit history, you will need to apply for a Canadian credit card. You can do this by visiting a Canadian bank or credit union, or by applying for a card online. Once you have your card, you can use it to make purchases and build your credit history. Your credit history will be reported to the credit bureaus, which will be used to calculate your credit score. The higher your credit score, the better your chances of being approved for loans and other financial privileges.

How to choose a bank account as a new immigrant

As someone newly introduced to the banking world, consider these suggestions when selecting a financial institution to use:

- Minimum balance requirements: Some bank accounts require you to maintain a minimum balance. If your balance drops below this requirement, you may incur a penalty.

- Automated Teller Machine (ATM): Some online banking accounts have a limit on how many withdrawals or Interac e-Transfer payments can be made through an Automated Teller Machine (ATM) or peer-to-peer connection each month.

- Cheque or draft fees: Emailing a receipt or bank draft for free comes with certain checking accounts. options that cost money include using a checkbook or a draft with 50 pages. One draft or receipt can cost from $10 to $50.

- Banking fees: Monthly fees are customary for checking accounts. Some checking accounts charge $0 every month, while other accounts charge up to $30.95. If your account balance exceeds the minimum requirement, you can waive the fees. Some banks charge a small monthly fee for issuing paper bank statements.

- Interest rates: Higher Interest Savings Accounts usually provide higher interest rates to help your savings grow faster.

- International remittance fees: As a new Canadian citizen, you may want to continue supporting your family back home financially. Before choosing a bank for regular international money transfers, check the cost of those transactions by searching for their remittance fees.

- Offers: financial institutions offer incentives at the time of account opening. This can include higher interest rates, free services, or cash bonuses. Opening an account and meeting certain criteria can also qualify for other incentives.

Getting deeper in banking system of Canada

In this part of the article, we will answer the frequently asked questions about the banking system in Canada.

- What is the minimum age to open a bank account in Canada?

The minimum age to open a bank account in Canada is 18. Individuals of 17 years of age and under need a legal guardian to open a bank account in Canada.

- How to apply for a credit card in Canada?

There are 3 ways that you can apply for a credit card in Canada:

- Online: The application process begins as soon as you select the “Apply Now” button for the credit card you like.

- In-person: Get in touch with the CIBC Banking Centre.

- Over the phone: You can call the customer care representatives.

- What are the fees for international transactions?

Whenever a transaction is made abroad or with a foreign vendor, a card company charges a foreign transaction fee. International transaction fees are usually between 1% and 3%

- What is the best way to send money to Canada from abroad?

You can use the fastest international money transfer services such as Western Union or MoneyGram. You need to provide the recipient’s information and the service transfers the money.

- What to know about online banking security?

- Create strong and unique passwords

- Use the multi-factor authentication that your bank offers.

- Don`t keep your account logged in.

- Don’t use online banking on public WIFI networks.

- Don’t use a shared computer to access your bank account.

- If you observed an unauthorized charge or withdrawal, report it to your bank immediately.

- Report stolen or lost cards to your bank immediately.

- Don`t supply your personal information when you receive a text or email as the banks are not allowed to ask you.

- Can I open a bank account in Canada with a Tourist Visa?

It is also possible to open a bank account or apply for a mortgage in Canada for non-residents with Temporary Resident Visas or as tourists.

- What are the options for people with bad credit in Canada?

The best option for people with bad credit in Canada is an unsecured credit card. On purchases, they earn rewards like cash back and points, and they don’t have to put down a security deposit.

- How do I close my bank account in Canada?

You have to contact the bank to close your account. you`ll need some identification and a closing fee.

- What are the fees for closing a bank account in Canada?

If you close your account before 15 days of opening, no fees are required. But after 15 days, they charge you 20$. Also, if you close your account in person at a local branch, you don’t need to pay any fees.

- Is it mandatory to have a credit history to open a bank account in Canada?

Chequing accounts do not require a credit check or a minimum balance, unlike credit cards. If you can’t find a job, don’t have money to deposit, or declare bankruptcy, you can open an account.

Credit and Debit Cards in Canada: Understanding the Differences and Choosing the Right One

Debit cards allow you to instantly transfer money from your bank account to the seller’s account. You can’t purchase more than you have in your bank account unless you have overdraft protection. Some people prefer to use debit cards as a way to control their spending for this reason.

Debit cards have transaction fees unless your banking contract offers free transactions. This is because they contain a line of credit linked to your account. Taking out money using a debit card won’t damage your line of credit. However, it would add fees to each withdrawal until you reach the limit for that line of credit.

You use your credit card to borrow money from the credit card issuer. This allows you to pay the vendor with borrowed money until you hit your credit limit. Then, you have to repay what you borrowed by the specified due date to avoid additional interest charges.

Canadian credit cards charge annual fees. In addition, they don’t tack on any additional fees for using the card for individual purchases. If you use the card to make purchases in foreign currency or for cash advances, you will be charged fees. Credit card fees vary for different types of credit cards.

Unlike credit cards that charge annual fees, debit cards don`t. Using debit cards, you don’t need to pay fees for withdrawing cash at the bank`s ATM. In contrast, credit cards may charge a high-interest rate for cash advances.

Loans and Mortgages in Canada: How to Apply and Qualify

Applying for a loan or a mortgage in Canada typically requires you to provide the lender with a variety of documents, such as proof of income, proof of employment and proof of identity. You must also have a good credit score and a history of making payments on time. The lender will then assess your application based on the documents you provide, as well as any other information they may need.

During the application process, you can expect to provide additional documentation and answer questions about your finances and credit history. Once the lender has reviewed your application, they will make a decision on whether to approve or deny your loan or mortgage request.

Investment and Wealth Management in Canada: How to Grow Your Money

In Canada, there are 2 ways of investment including low-risk investments and high-risk investments. Considering your investment goals and your risk tolerance as an investor, you can choose the most suitable investment option. Here we discuss investment options for high-risk and low-risk investments.

Exchange-traded funds

As it invests in securities, it is traded on the stock exchange and its value depends on the stock market.

- High-risk investments: A high-risk investment is one that does not guarantee a return or capital. Investing in a hedge fund can be risky if a negative outcome occurs, but it can also be lucrative if a positive outcome occurs.

- Stocks: It will be bought and sold on the stock market.

- Mutual funds: A professional manages a mutual fund. It uses investor funds to invest in securities.

Low-risk investments

Capital and return are guaranteed by low-risk investments.

- Guaranteed investment certificates (GICS): Insured investors purchase guaranteed investment certificates in order to protect their capital during the investment process.

- Bonds: In exchange for interest paid on a loan made to a company, an investor obtains a bond from the company. When the bond matures, the investor repays the loan.

- Treasury bills: The only difference between Treasury bills and bonds is that the loan belongs to the government and the interest payments on the loan will be returned to the investor.

- High-interest savings accounts: It offers higher interest rates.

How to create a financial plan and set investment goals?

Creating a financial plan and setting investment goals is an important step in managing your finances. A financial plan is a document that outlines your current financial situation, including your income, expenses, and debts, as well as your goals for the future. It should also include a plan for how you will achieve those goals, including how you will pay off debts and save for retirement.

Once you have a financial plan in place, you can then set investment goals. These should be specific and measurable, such as a target rate of return, a timeline for achieving the goal, and a risk tolerance level. You should also consider the types of investments you want to make and determine how much money you need to invest in order to reach your goals.

Banking and Taxes in Canada: How to Manage Your Taxes with Your Bank

How to manage your taxes with your bank in Canada?

Managing your taxes with your bank in Canada can be done in a few simple steps. First, you need to make sure that you are registered with the Canada Revenue Agency (CRA) and that your bank account is set up to accept direct deposits from the CRA. Then, when you file your taxes each year, you should provide your banking information to the CRA so that they can deposit the refund directly into your account.

Your bank can also help you with filing your taxes by providing the necessary forms and helping you calculate your taxes. Finally, you should keep track of all the deductions and credits you can claim on your taxes in order to maximize your refund.

How to file taxes electronically

Filing your taxes electronically in Canada is a quick and easy process. You can file your taxes either through the Canada Revenue Agency’s (CRA) website or through a third-party tax preparation software. To file your taxes electronically, you’ll need to register with the CRA’s My Account service and provide your banking information so the CRA can deposit any refund directly into your account. Once registered, you can use the CRA’s web forms to enter your personal and financial information and submit your taxes online.

If you’re using a third-party tax preparation software, you’ll need to enter your information into the software and then submit your taxes to the CRA. Either way, you should receive a confirmation that your taxes have been filed and processed.

How to set up direct deposit for tax refunds

Direct deposit is easy to use because it just needs the account number and routing number for the tax software. Then choose it as a refund option. Tell your tax preparer that you want direct deposit so they can process your taxes through automated payments. Alternatively, you can file by paper if few people still use direct deposit.

How to use online banking to access your tax information

To access your tax account through the IRS, sign into your secure account at IRS.gov/account. Once there, you can view information about your balance and how much you owe as well as view 18 months of payment history. You can also access Get Transcript, which allows you to request a copy of your current year’s tax return, and view the key information from your tax return.

Banking and Small Business in Canada: How to Manage Your Finances

As a small business owner in Canada, there are several steps you can take to help manage your finances.

- Setting up a business bank account: It is important to have a separate business bank account to ensure that your business finances are kept separate from your personal finances. Most banks will provide business accounts with features specifically designed for business banking. Make sure to ask about any special features or services that may be available.

- Applying for a business loan: Depending on the size and type of business you are running, you may need to apply for a business loan. Different banks offer different loan options so it is important to shop around and compare the different loans available. Be sure to carefully read through the terms and conditions of each loan before you apply.

- Using online banking to manage expenses and revenues: Many banks offer online banking services that allow you to view your business accounts and transactions anytime and from anywhere. This is a great way to manage your expenses and revenues, as well as to track any payments you have made or received.

By following these steps, you can help manage your finances more efficiently and successfully.

Conclusion

Banking in Canada is regulated by the federal government, with the Bank of Canada (BoC) as the central bank. All banks in Canada must be members of the Canadian Payments Association (CPA) and must adhere to federal regulations. Some of the key points of this article are:

- All banks in Canada must be members of the Canadian Payments Association (CPA).

- Banks must adhere to federal regulations and follow the guidelines of the Bank of Canada (BoC).

- All banks must be insured by the Canada Deposit Insurance Corporation (CDIC) for deposits up to a certain limit.

- All banks must provide a range of services, such as online banking, debit and credit cards, and ATMs.

- Banks must comply with anti-money laundering and anti-terrorist financing regulations.

- Banks must provide customers with access to their accounts and must protect customer information.

- Banks must adhere to the Privacy Act, which sets out the rules for how banks must protect customer information.

- Banks must provide customers with clear information on the fees and charges associated with their banking products.

- https://www.canada.ca/en/financial-consumer-agency/services/banking.html

- https://www.canada.ca/en/financial-consumer-agency/services/banking/using-debit.html

- https://www.canada.ca/en/financial-consumer-agency/services/banking/online-banking.html

- https://www.thecanadianencyclopedia.ca/en/article/banking

- https://www.pexels.com/photo/person-putting-coin-in-a-piggy-bank-1602726/