Taxes in Canada, a Means to Ensure Welfare Is Distributed Equally Between All!

In many countries, if not all, the taxation system provides the government with financial assets to govern (hopefully to govern better!). Canada is no exempt, so, the income of the taxing is the major revenue for the federal and provincial governments in Canada. There are different kinds of taxes in Canada:

In this article we talk about taxes in Canada, different kinds of taxes that the Canadian people along with the residents there must pay, and how much those taxes cost. So, if you are interested don’t go anywhere, we are here for you!

Table of Contents

Income Taxes in Canada

Income taxes are a form of taxes levied directly on your income, or on you corporation. Below we discussed different kinds of income taxes in Canada.

Personal Income Taxes

It is a form of tax in Canada on individuals obliged by both federal and provincial governments. About 45% of tax revenue is from personal income taxes. A more detailed explanation of the rates is below the descriptions. If you are interested about income of different industries in Canada, you can read this article.

Corporate Taxes

A form of taxation for companies and corporations based on their capital. The tax is taken from corporations based on their income before sharing it between the shareholders.

International Taxation

If Canadian residents or corporations have incomes worldwide, this taxing system applies to them. For non-resident citizens, there are ways to deduct taxes in order to avoid double taxation.

Payroll Taxes

A tax paid by employers based on their payroll, the amount might differ in different jurisdictions.

Consumption Taxes in Canada

Consumption taxes are a kind of tax on the purchases of goods and services. It can be in forms of tariffs, sales taxes, excise taxes, and other kinds of taxes. Here we will take a look at some of them that are levied in Canada.

Sales Taxes

A 5% tax is levied by the federal government, which is called “Goods and Services Tax (GST)”. The amount added by provincial governments is not the same. Some provinces have changed it to “Harmonized Sales Taxes (HST)”, some have their Retail Sales Tax, and Quebec has its own value-added tax, called Quebec Sales Tax. Alberta and the three territories don’t have their own sales taxes. To sum it up, sales taxes are between 5% and 15% throughout Canada.

Excise Taxes

It is a tax form implemented on inelastic goods like gasoline, alcohol, cigarettes, and vehicle air conditioners. Tax rates on cigarettes and alcohol in Canada are one of the highest rates in the world; it is believed that these taxes, also called sin taxes, help with health among the society, thus decreasing health system costs.

Capital Gains Tax

It is a tax imposed upon sales of certain things such as stocks, real estate, bonds, precious metals, and property. There are exceptions in Canada, for example, when someone sells their primary residence.

Wealth Taxes

Wealth taxes is defined as taxes that are based on your assets. Property taxes is a common form of wealth taxes in Canada.

Property Taxes

Property taxes in Canada are a form of taxes levied directly on properties. It is based on the value of the property mostly.

Annual Property Taxes

The base funds for the municipal level of governments are usually earned through annual property taxes, which are imposed on residential, industrial, and commercial properties. As the name suggests, the rate is different annually based on the needed budget determined by the municipal government.

Land Transfer Tax

This type of tax is implemented when land or property is transferred. Its calculation is based on the value of the land or property and the marginal tax rate. There are rules and exceptions in different provinces on this kind of tax.

How to calculate taxes in Canada?

In this part we give you a gist of how to calculate taxes, hoping it helps you in future. Keep in mind that the tax rates might be subject of changes in future.

How to calculate personal income taxes in Canada?

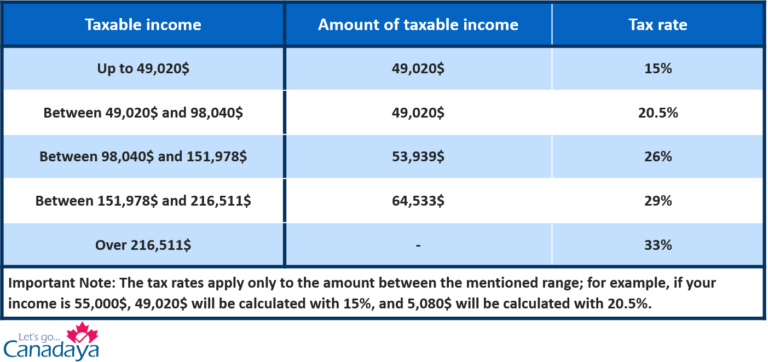

Personal income taxes consist of 2 parts in Canada: Federal taxes and provincial taxes. The table below shows the federal income tax calculation:

Each province has its rate of personal income taxes; the table below helps you calculate the amount of personal income tax in each province.

To get a better understanding, let’s take an example. For someone who lives in Alberta and has an income of 160,000$ a year, here is how their personal income tax is calculated:

Federal Tax:

160,000$ is between 151,978$ and 216,511$, so the first 49,020$ has a 15%, the next 49,020$ has a 20.5%, the next 53,939$ has a 26%, and the rest has a 29% tax rate. So:

Federal Tax = (49020 x 15/100) + (49020 x 20.5/100) + (53939 x 26/100) + (8022 x 29/100)

So the federal tax equals to 33,752.62$

Provincial Tax:

160,000$ is between 157,464$ and 209,952$, so the first 131,220$ has a 10%, the next 26,244$ has a 12%, and the next 2,536$ has a 13% tax rate. So:

Provincial Tax = (131,220 x 10/100) + (26,244 x 12/100) + (2536 x 13/100)

So the provincial tax equals to 16,600.96$

Personal Income Tax = 50,353.58$

How sales taxes are calculated in Canada?

As mentioned earlier, like personal income tax, it has 2 parts, federal tax and governmental taxes levied by provinces. You can see the amount of this tax in the table below.

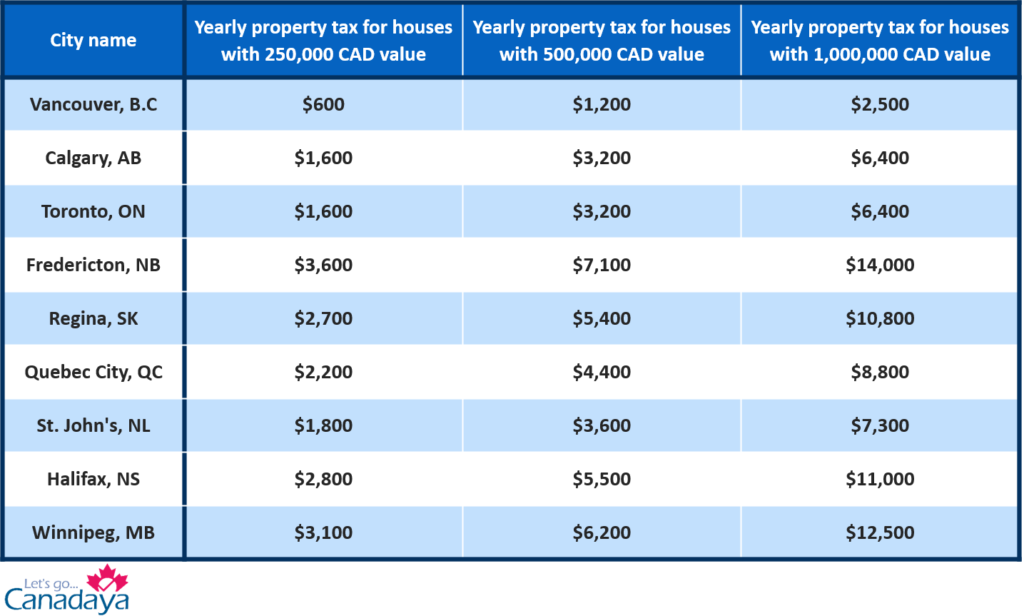

How to calculate annual property taxes in Canada?

As explained, the amount of this tax is determined yearly, so giving an exact number or a way to calculate is not possible. For most people, this type of tax applies to the house they own. To get a general idea of how much must be paid for this tax, let’s have a few examples from 2020, but keep in mind the numbers are not exact.

Last words on taxes in Canada

In this article we looked at the taxes in Canada and matters related to it. As you have noticed, the amount of money one needs to pay as taxes is a notable number. But the good news is that unlike some other countries, this money is used for the welfare of citizens and residents.

Here we finish our article on Taxes in Canada, hoping that it could be useful for you. If you are interested in knowing more about Canada, check our other articles on Geography, Politics, Socio-cultural, and historical aspects of Canada.

- https://en.wikipedia.org/wiki/Taxation_in_Canada

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html

- https://www.revenuquebec.ca/en/citizens/income-tax-return/completing-your-income-tax-return/income-tax-rates/

- https://www.retailcouncil.org/resources/quick-facts/sales-tax-rates-by-province/

- https://www.wealthsimple.com/en-ca/learn/canadian-property-taxes

- https://commons.wikimedia.org/wiki/File:Income-tax-491626_1920_(1).jpg