Children’s Whole Life Insurance in Canada; Protecting Their Future

Children’s whole life insurance in Canada is an essential financial tool that provides parents and guardians with peace of mind, knowing that their children’s financial future is secure. This comprehensive guide aims to help you understand the intricacies of children’s whole life insurance in Canada, covering everything from the basics to the fine print. Whether you’re a parent planning for your child’s financial security or a guardian looking to make informed decisions, this guide is your one-stop resource.

Key takeaways:

- Children’s whole life insurance in Canada ensures lifelong coverage, guaranteed death benefits, and cash value accumulation for financial security.

- Benefits include financial security, tax advantages, cash value for needs, and guaranteed insurability.

- Tax implications include premium, death benefit, and tax-efficient strategies.

- Traditional, universal, and term life insurance offer stability, flexibility with investments, and temporary coverage, respectively.

- Applying includes age limits check, medical exams, application, and underwriting.

- Policy management covers reviewing, beneficiaries, and handling loans/withdrawals.

Table of Contents

Understanding Children’s Whole Life Insurance

What is Children’s Whole Life Insurance?

Children’s whole life insurance is a type of life insurance policy designed to provide financial protection for children. It guarantees a death benefit payout when the insured child passes away, ensuring that the family has financial support during a difficult time. Additionally, this insurance offers an opportunity for cash value accumulation over time, making it a potential savings vehicle.

Unlike term life insurance, which provides coverage for a specific term, children’s whole life insurance is permanent and lasts for the entire life of the insured as long as premiums are paid. It is often purchased by parents or guardians to secure their child’s financial future.

Key Features of Children’s Whole Life Insurance:

- Lifelong coverage

- Guaranteed death benefit

- Cash value accumulation

- Fixed premiums

Why Should You Consider It?

There are several compelling reasons to consider purchasing children’s whole life insurance:

Financial Security: It provides a safety net for your child’s future. In the unfortunate event of their passing, the death benefit can help cover funeral expenses, outstanding debts, and provide financial support to the family.

Tax Benefits: The cash value component of whole life insurance grows tax-deferred. In Canada, there are tax advantages associated with the policy, making it a tax-efficient way to save and invest for your child’s future.

Guaranteed Insurability: By purchasing a whole life insurance policy for your child, you lock in their insurability at a young age, regardless of any future health issues. This ensures they have access to life insurance as adults.

Cash Value Accumulation: Whole life insurance policies build cash value over time, which can be used for various financial needs, such as education expenses, down payments on a home, or retirement planning.

Legacy Planning: It allows you to create a financial legacy for your child or grandchild, ensuring that they have a head start in life when it comes to financial security.

Types of Children’s Whole Life Insurance

In Canada, children’s whole life insurance comes in various forms to suit diverse needs. Options include traditional whole life policies, universal life plans offering flexibility, and term life insurance with potential cash value growth tied to market performance. Each type offers unique benefits, ensuring you find the right coverage for your child’s future financial security.

Traditional Whole Life Insurance

Traditional whole life insurance provides a guaranteed death benefit and cash value accumulation. The premiums are usually fixed, and the policy remains in force as long as they are paid. This type of insurance is known for its stability and is often chosen by parents looking for a reliable long-term financial solution for their child.

Advantages of Traditional Whole Life Insurance:

- Guaranteed death benefit

- Cash value growth

- Premium stability

- Potential dividends

Considerations:

- Slightly higher premiums compared to term life insurance

- Limited flexibility in premium payments

Universal Life Insurance

Universal life insurance combines life insurance coverage with an investment component. It offers flexibility in premium payments and allows policyholders to invest in various funds, including equities and bonds. Universal life insurance may be suitable for parents seeking both insurance coverage and potential investment growth for their child.

Advantages of Universal Life Insurance:

- Flexible premium payments

- Investment component

- Adjustable death benefit

- Potential tax advantages

Considerations:

- Investment risk

- Complex policy structure

- Premium fluctuations

Term Life Insurance

Term life insurance provides coverage for a specific term, such as 10, 20, or 30 years. While it may not be a typical choice for children, some parents consider it due to its affordability. Term life insurance is an option for short-term financial protection but does not build cash value like whole life insurance.

Advantages of Term Life Insurance:

- Lower premiums

- Temporary financial protection

- Simplicity

Considerations:

- No cash value

- Coverage limitations

- Limited suitability for children

Benefits of Children’s Whole Life Insurance

Financial Security

Children’s whole life insurance offers a crucial safety net for families. In the event of the insured child’s passing, the policy provides a death benefit that can be used to cover immediate expenses, such as funeral costs, outstanding debts, and ongoing financial support for the family. This financial security is a cornerstone of why parents and guardians choose this type of insurance.

Death Benefit Payout:

- Coverage for funeral expenses

- Assistance with debts and mortgage payments

- Replaces lost income for the family

Emotional Support:

- Reduces financial stress during a difficult time

- Allows time for grieving without immediate financial concerns

Tax Benefits

In Canada, whole life insurance comes with significant tax advantages. The cash value component of the policy grows tax-deferred, meaning you don’t pay taxes on the growth until you withdraw funds. This tax-efficient growth makes whole life insurance an attractive option for building wealth for your child’s future.

Tax-Deferred Growth:

- Avoid capital gains tax on investment growth

- Tax-free policy loans and withdrawals

- Tax-efficient way to save for your child’s future

Estate Planning Benefits:

- Tax-free death benefit for beneficiaries

- Potential for leveraging the insurance policy for estate planning

Cash Value Accumulation

One of the distinguishing features of whole life insurance is the cash value component. A portion of your premium payments goes into a cash value account that grows over time. This cash value can be borrowed against, used for various financial needs, or left to accumulate, potentially serving as a significant financial asset for your child in the future.

Using Cash Value:

- Education expenses

- Home down payment

- Retirement income

- Emergency fund

Guaranteed Growth:

- Conservative, stable growth

- Protection against market volatility

Guaranteed Insurability

One of the less-discussed but incredibly valuable aspects of children’s whole life insurance is the guaranteed insurability it provides. By securing a policy for your child at a young age, you ensure that they have access to life insurance as adults, regardless of any future health issues. This guarantees that they can protect their own families without the fear of uninsurability.

Lifetime Coverage:

- Ensures lifelong access to insurance

- Locks in insurability regardless of health changes

- Peace of mind for your child’s future

Considerations Before Purchasing

Determining the Coverage Amount

Deciding on the appropriate coverage amount is a critical step in purchasing children’s whole life insurance. Consider your child’s immediate and future financial needs, such as funeral costs, outstanding debts, education expenses, and the level of support you want to provide for your family in case of tragedy.

Calculating Coverage Needs:

- Funeral expenses

- Outstanding debts

- Income replacement for the family

- Future financial goals

Reviewing Coverage Periods:

- Immediate financial needs vs. long-term support

Choosing the Right Insurance Company

Selecting a reputable insurance company is crucial. Look for an insurer with a strong track record, financial stability, and excellent customer service. You want to ensure that the company will be there to honor the policy when needed.

Researching Insurers:

- Financial strength ratings

- Customer reviews and ratings

- Claim payment history

Comparing Policies:

- Different policies from various insurers

- Policy features, riders, and options

Policy Riders and Add-ons

Whole life insurance policies often come with the option to add riders or additional features to tailor the coverage to your specific needs. Some common riders include:

Child Term Rider: Provides coverage for other children in the family.

Accidental Death Benefit Rider: Increases the death benefit in case of accidental death.

Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled.

Evaluating Rider Necessity:

- Assessing the need for additional coverage

- Impact on premium costs

- Customizing the policy to your family’s needs

Premium Costs and Payment Options

The cost of premiums can vary significantly depending on the type of policy, coverage amount, and the age and health of the insured child. Understanding the premium structure and payment options is essential for budgeting and long-term planning.

Factors Affecting Premiums:

- Child’s age and health

- Coverage amount

- Type of policy

- Length of premium payments

Premium Payment Options:

- Annual, semi-annual, quarterly, or monthly payments

- Options for premium financing

- Impact on policy cost

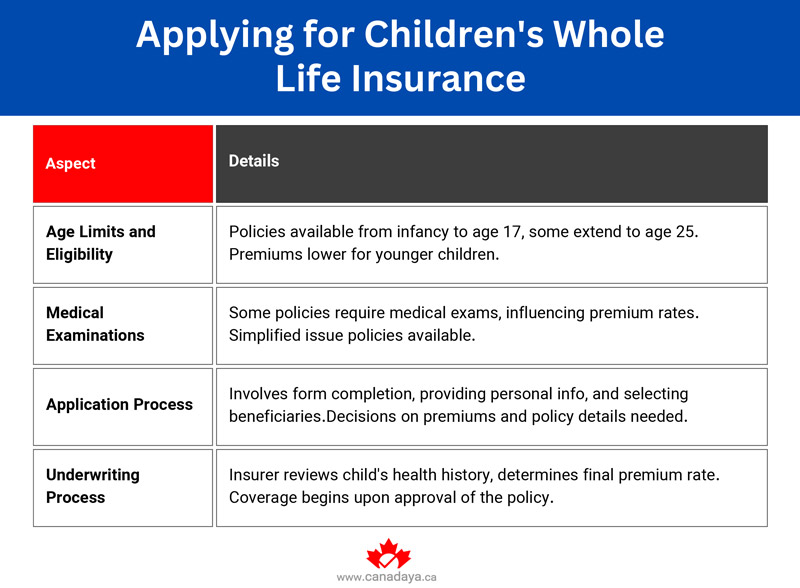

Applying for Children’s Whole Life Insurance

When applying for Children’s Whole Life Insurance, consider future needs, gather documents, and choose the best policy for lifelong protection. here are some steps when applying for Children’s Whole Life Insurance:

Age Limits and Eligibility

Children’s whole life insurance policies are typically available for children from infancy to age 17, with some insurers offering policies for young adults up to age 25. The younger the child, the lower the premiums are likely to be.

Infant Policies:

- Coverage for newborns

- Locking in lower premiums at a young age

Young Adult Policies:

- Extending coverage for older children

- Higher premiums but still advantageous

Medical Examinations

Depending on the insurance company and the type of policy, a medical examination may be required. Medical underwriting helps determine the child’s health and risk profile, influencing premium rates. Some insurers offer simplified issue policies that do not require a medical exam.

Simplified Issue Policies:

- No medical exam required

- Slightly higher premiums

- Suitable for children with health issues

Full Medical Underwriting:

- In-depth health assessment

- Potential for lower premiums for healthy children

Application Process

The application process for children’s whole life insurance typically involves filling out an application form, providing the child’s personal information, and designating beneficiaries. Additionally, you’ll need to make decisions regarding premium payments, riders, and other policy details.

Required Documentation:

- Birth certificate

- Beneficiary information

- Health questionnaire (if applicable)

Completing the Application:

- Online applications vs. paper applications

- Consultation with an insurance agent

Underwriting Process

After submitting the application, the insurance company will review the child’s health history and assess their risk. The underwriting process determines the final premium rate for the policy. Once approved, the policy is issued, and coverage begins.

Underwriting Factors:

- Health history

- Family medical history

- Lifestyle factors

- Hobbies and activities

Policy Issuance:

- Policy documents and delivery

- Effective date of coverage

- Payment schedule

Policy Management and Beneficiary Designation

Reviewing and Updating the Policy

It’s important to periodically review and update your child’s whole life insurance policy to ensure it continues to meet your family’s needs. Life changes, such as marriage, the birth of additional children, or changing financial goals, may necessitate adjustments to the policy.

Regular Policy Reviews:

- Assessing the coverage amount

- Adding or removing riders

- Adjusting premium payments

Beneficiary Updates:

- Adding new beneficiaries

- Modifying beneficiary designations

- Addressing changing family dynamics

Designating Beneficiaries

When you purchase a whole life insurance policy for your child, you will need to designate one or more beneficiaries. Beneficiaries are the individuals or entities that will receive the death benefit when the insured child passes away.

Types of Beneficiaries:

- Primary beneficiaries

- Contingent beneficiaries

- Trusts and legal entities

Beneficiary Designation Considerations:

- Protecting the interests of the insured child

- Ensuring a smooth claims process

- Estate planning and tax implications

Handling Policy Loans and Withdrawals

Whole life insurance policies offer the option to take policy loans against the cash value or make partial withdrawals. These features can be useful for accessing funds when needed but should be managed carefully to ensure the long-term viability of the policy.

Policy Loans:

- Borrowing against the cash value

- Interest rates and repayment options

- Impact on the death benefit

Partial Withdrawals:

- Accessing a portion of the cash value

- Tax implications and consequences

- Balancing policy growth and financial needs

Tax Implications

Taxation of Premiums

Premiums paid for children’s whole life insurance are generally not tax-deductible in Canada. However, there are some exceptions, such as when the policy is structured for estate planning purposes. It’s essential to understand the tax treatment of premiums based on your specific policy and financial goals.

General Premium Taxation:

- Non-deductible premiums

- Tax neutrality for most policies

- Exceptions for estate planning

Premium Taxation for Estate Planning:

- Premiums for business purposes

- Structured estate planning policies

- Consultation with a tax advisor

Taxation of Death Benefits

In Canada, the death benefit paid out by a children’s whole life insurance policy is generally received tax-free. This means that the beneficiaries do not need to pay income tax on the proceeds, providing valuable financial support to the family during a challenging time.

Taxation of Cash Value

The cash value component of whole life insurance policies grows tax-deferred. This means you won’t pay taxes on the growth until you withdraw funds or surrender the policy. The tax-deferred growth can be a significant advantage for long-term wealth accumulation.

Tax-Deferred Growth:

- No taxes on cash value growth

- Potential for substantial tax savings

- Impact on overall financial planning

Tax-Advantaged Strategies

To maximize the tax advantages of children’s whole life insurance, it’s essential to understand and implement tax-efficient strategies. These may include using the policy for estate planning, taking advantage of tax-free withdrawals, and managing the policy in a way that minimizes tax liabilities.

Estate Planning Strategies:

- Using the policy to transfer wealth tax-efficiently

- Leveraging tax-free death benefits for estate liquidity

- Structuring the policy to minimize estate taxes

Tax-Efficient Withdrawals:

- Strategies for accessing cash value without triggering taxes

- Maximizing the tax-free nature of the policy

Comparison: Children’s Whole Life Insurance vs. Other Investment Options

RESP (Registered Education Savings Plan)

While children’s whole life insurance can be used to save for education expenses, the RESP is a dedicated savings plan designed to help parents and guardians save for their child’s post-secondary education. Comparing these options helps you make informed financial decisions.

RESP Features:

- Tax advantages for education savings

- Government grants (Canada Education Savings Grant)

- Investment options within the RESP

Choosing Between RESP and Whole Life Insurance:

- Combining both for comprehensive financial planning

- RESP for education, whole life insurance for broader needs

TFSA (Tax-Free Savings Account)

The TFSA is a tax-advantaged savings account that allows individuals to earn tax-free investment income. It can be a valuable tool for both adults and children when saving for various financial goals.

TFSA Features:

- Tax-free investment growth

- Flexibility in contributions and withdrawals

- No restrictions on the use of funds

Comparing TFSA and Whole Life Insurance:

- TFSA for flexible, tax-free savings

- Whole life insurance for insurance protection and long-term wealth

Investment Accounts

Traditional investment accounts, such as brokerage or investment funds, offer flexibility and potentially higher returns than insurance-based savings vehicles. Comparing investment accounts with children’s whole life insurance helps you understand the trade-offs.

Investment Account Features:

- Choice of investments (stocks, bonds, mutual funds)

- No restrictions on withdrawals

- Potential for higher returns

Choosing Between Investment Accounts and Whole Life Insurance:

- Investment accounts for growth-oriented savings

- Whole life insurance for guaranteed protection and cash value growth

GICs (Guaranteed Investment Certificates)

GICs are low-risk, interest-bearing investments offered by banks and credit unions. They provide a guaranteed return on the investment, making them a conservative savings option.

GIC Features:

- Guaranteed interest rate

- Principal protection

- Limited growth potential

Comparing GICs and Whole Life Insurance:

- GICs for conservative, low-risk savings

- Whole life insurance for growth, protection, and tax advantages

Case Studies

X and Y’s Decision to Purchase Children’s Whole Life Insurance

In this case study, we explore how Sarah and John, new parents, decide to purchase a whole life insurance policy for their newborn child, Z. We break down their considerations, policy selection, and how they plan to use the policy to secure Z’s financial future.

Financial Background:

- New parents

- Long-term financial goals

- Concerns about Emily’s financial security

Policy Selection and Features:

- Type of policy chosen

- Coverage amount and riders

- Premium payment strategy

Emily’s Future Financial Security:

- Ensuring Emily’s financial well-being

- Long-term planning for her education, homeownership, and retirement

Comparing A’s RESP and B’s Whole Life Insurance

In this case study, we compare two different approaches to saving for a child’s future. A uses a Registered Education Savings Plan (RESP), while B opts for children’s whole life insurance. We examine the pros and cons of each strategy and the impact on their children’s financial future.

A’s RESP Strategy:

- Saving for education expenses

- Government grants and tax benefits

- Limited flexibility for other financial goals

B’s Whole Life Insurance Strategy:

- Providing both insurance protection and long-term wealth

- Tax advantages and flexibility

- Building a financial legacy for her child

Comparing Outcomes:

- Which strategy offers more comprehensive financial security

- Balancing education savings with broader financial needs

Frequently Asked Questions

Can I purchase children’s whole life insurance for grandchildren?

Yes, it’s possible to purchase children’s whole life insurance for grandchildren. Many grandparents choose to do so to provide financial security and potentially transfer wealth to their grandchildren.

Key Considerations:

- Insurability and eligibility

- Grandparent as policyholder

- Gifting premiums to grandchildren

What happens if I can’t pay the premiums?

If you can’t pay the premiums for your child’s whole life insurance policy, there are several options available to keep the policy in force, such as using the cash value to cover premiums, reducing coverage, or converting to a paid-up policy.

Premium Payment Options:

- Premium financing

- Using cash value to cover premiums

- Adjusting coverage to fit your budget

How do dividends work in whole life insurance?

Dividends in whole life insurance are typically paid to policyholders when the insurance company performs well financially. Policyholders can choose to receive dividends as cash, use them to reduce premiums, purchase additional coverage, or leave them to accumulate.

Dividend Options:

- Receiving cash payments

- Premium reductions

- Purchasing paid-up additions

Is it possible to transfer ownership of the policy?

transfer ownership of a children’s whole life insurance policy. This transfer can be done to the insured child when they reach adulthood or to another adult individual. The process varies by insurer and may involve specific requirements.

Ownership Transfer Scenarios:

- Transferring to the insured child

- Transferring to another adult family member

- Policy provisions and requirements

Conclusion

Making Informed Decisions

Purchasing children’s whole life insurance in Canada is a significant decision with far-reaching implications for your child’s financial future. This comprehensive guide has explored the ins and outs of this financial tool, from understanding the types of insurance available to considering tax implications and comparing it with other investment options. We’ve also provided real-life case studies and addressed frequently asked questions.

Secure Your Child’s Financial Future

Ultimately, the decision to purchase children’s whole life insurance is a deeply personal one, influenced by your family’s unique financial goals and priorities. As you navigate the world of insurance, we encourage you to consult with financial advisors, insurance experts, and tax professionals to make the best decisions for your child’s future. By securing your child’s financial future, you are providing them with a lasting legacy of stability and opportunity.