Disability Insurance in Canada: Ensuring a Future of Calmness!

Disability insurance in Canada is a cornerstone of financial planning, offering essential protection and security to individuals facing potential income loss due to illness or injury. In this comprehensive guide, we will delve deep into the world of disability insurance in Canada. We will cover its significance and various types, explore eligibility requirements, delve into the benefits it offers, and discuss critical factors to consider when choosing the right policy.

Key takeaways:

- Disability insurance in Canada provides crucial financial stability in the event of illness or injury-related income loss.

- Various policy types, including short-term, long-term, group, and individual, address different disability coverage needs.

- Eligibility for disability insurance in Canada hinges on age, health status, and occupation, with specific policies for high-risk jobs.

- Disability insurance benefits encompass income replacement, rehabilitation support, survivor benefits, inflation adjustments, and work-return incentives.

- Choosing a disability insurance policy involves assessing coverage needs, benefit duration, premium costs, and insurer reliability.

- Disability benefits in Canada may be tax-free, and tax credits can lessen the disability’s financial impact.

- Self-employed Canadians must navigate unique insurance challenges, with individual and group plans available.

Table of Contents

Understanding the Need for Disability Insurance in Canada

Disabilities can leave a devastating impact on the life of affected individuals. We will discuss the necessity for disabiltiy insurance in Canada in the following section.

Recognizing the Financial Risk

Disability insurance in Canada is your safety net when life takes an unexpected turn. It shields you from the financial storm that can arise from sudden disability due to illness or injury. By understanding the potential risks, you can better appreciate the significance of this insurance.

Maintaining Financial Stability

Picture your life if you couldn’t work due to a disability. Bills, mortgages, and daily expenses don’t disappear. Disability insurance in Canada ensures that you can keep the financial wheels turning, maintaining your quality of life.

Complementing Government Support

Canada offers essential government programs like the Canada Pension Plan Disability Benefits and Employment Insurance Sickness Benefits. However, these might not cover all your financial needs. Disability insurance in Canada fills the gaps, offering you additional financial protection.

Types of Disability Insurance in Canada

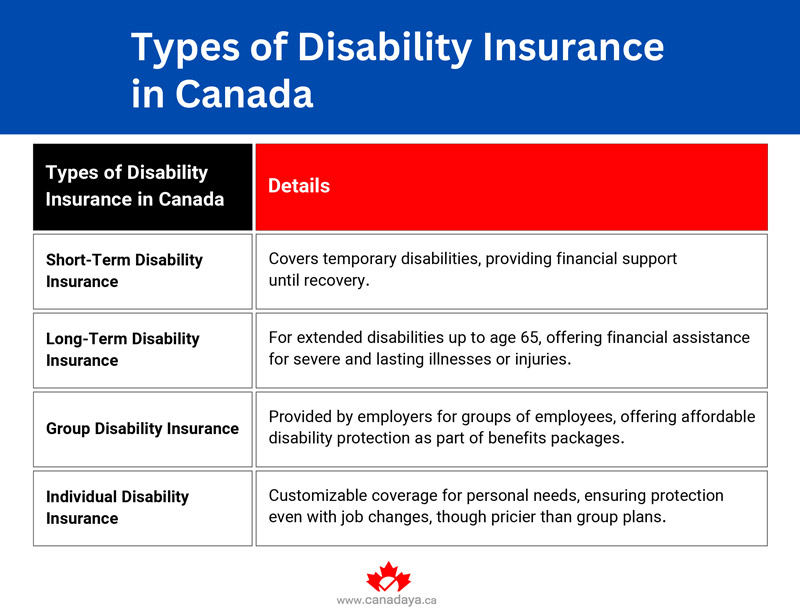

Canada offers diverse disability insurance types which are suitable for you based on your needs, as you can see in the table below:

Short-Term Disability Insurance

Short-term disability insurance provides coverage for temporary disabilities. It offers financial support during the early stages of your disability, ensuring that you have income until you recover.

Long-Term Disability Insurance

Long-term disability insurance in Canada is designed for extended disabilities expected to last up to age 65. It becomes a lifeline in the case of severe and lasting illnesses or injuries.

Group Disability Insurance

Employers often offer group disability insurance as part of their benefits package. It covers a group of employees, providing an affordable way to access disability protection.

Individual Disability Insurance

For those seeking personalized coverage, individual disability insurance in Canada offers flexibility and can be customized to your unique needs. While it can be pricier, it ensures coverage even if you change jobs.

Eligibility and Qualifications for Disability Insurance

Similar to other types of insurance, disability insurance in Canada has a criteria every individual has to fulfil before becoming eligible for this type of insurance.

Age Requirements

Most disability insurance policies require applicants to be between 18 and 65 years old. Some insurers extend coverage beyond 65, but at a higher premium.

Health Assessments

Insurers typically evaluate your health through medical examinations and assessments. Your health history, pre-existing conditions, and lifestyle choices can affect the availability and cost of your coverage.

Occupation-Specific Policies

Certain professions with higher risks may need specialized policies tailored to their unique challenges. These policies address the specific demands of different job types.

Dissecting Disability Insurance Benefits

Next, we will cover the benefits eligible receivers of the disability insurance in Canada have the privilege of using.

Income Replacement

The primary benefit of disability insurance in Canada is income replacement. It provides a portion of your pre-disability income, ensuring you can meet your essential expenses.

Rehabilitation Benefits

Some policies offer rehabilitation benefits, aiding your recovery process. They may cover vocational training, education, or medical treatments to help you return to work.

Survivor Benefits

In the unfortunate event of the policyholder’s death, survivor benefits may be paid to beneficiaries, offering financial support during a difficult period.

Cost-of-Living Adjustments

To counteract inflation, many policies include cost-of-living adjustments (COLA). These adjustments maintain the real value of your disability benefits over time.

Return-to-Work Incentives

Several policies encourage returning to work by providing partial benefits even after resuming employment. This promotes a gradual transition back into the workforce.

Key Considerations When Selecting Disability Insurance in Canada

Selecting a suitable disability insurance in Canada which meets every one of your needs is of high importance. In the next section we will go over the essential factors you should pay heed to while choosing an insurance.

Determining the Adequate Coverage Amount

Select a coverage amount that covers your essential expenses, such as housing, groceries, and medical costs. Your goal is to maintain your quality of life in case of disability.

Understanding Waiting Periods

The waiting period, or elimination period, is the time you must wait after becoming disabled before receiving benefits. Longer waiting periods can lead to lower premiums.

Defining the Appropriate Benefit Period

The benefit period determines how long you’ll receive disability benefits. Select a period that aligns with your long-term financial goals and expectations.

Budgeting for Premiums

Consider the cost of premiums in your budget. Premiums can vary based on age, health, occupation, and chosen coverage.

Exclusions, Riders, and Policy Customization

Study the policy’s exclusions to understand what conditions or circumstances are not covered. Additionally, explore optional riders that offer extra coverage tailored to your needs.

Evaluating Insurer Reputation

Choosing a reputable insurer is paramount. Assess their financial stability, customer service, and claims processing history to ensure they are reliable when you need them most.

Government Disability Programs in Canada

Alongside private coverage, government disability insurance in Canada is also available. Follow along as we explain this option furtherm0ore.

Canada Pension Plan Disability Benefits

The Canada Pension Plan (CPP) Disability Benefits offer financial support to individuals who meet specific eligibility criteria. To qualify, applicants must demonstrate a severe and prolonged disability and have made sufficient CPP contributions.

Employment Insurance Sickness Benefits

Employment Insurance (EI) Sickness Benefits provide temporary income replacement for individuals unable to work due to illness or injury. Eligibility requires past EI premium payments and meeting specific criteria.

Provincial and Territorial Disability Programs

Each province and territory in Canada has its own disability support programs. Eligibility and benefits vary, making it important to understand the regional options available to you.

Navigating the Application and Claims Process

The application process could come off as complicated and scare away people from proceeding further. this section is dedicated to discussing the application process of claiming disability insurance in Canada.

Initiating the Disability Insurance Application

Applying for disability insurance in Canada involves completing an application form, providing medical information, and, in some cases, undergoing a medical examination. Honesty and accuracy are vital during this process.

Gathering Required Documents

Typically, you’ll need to provide medical records, employment records, and other documentation to substantiate your disability. The insurer will assess your claim based on the information you provide.

Insight into the Claims Process

If you become disabled and need to make a claim, notify your insurer promptly. The claims process involves submitting a claim form and supporting documents. The insurer will assess your eligibility for benefits.

Appeals for Denied Claims

In the event of a denied claim, you have the right to appeal. The appeals process allows you to present additional evidence or challenge the insurer’s decision. Understanding your policy and the reasons for denial is crucial when appealing.

Tax Implications of Disability Benefits

Unfortunately, disability insurance in Canada is considered taxable and therefore requires prompt knowledge of the applicable taxesto navigate the rates.

Taxation of Disability Benefits

In Canada, disability benefits are typically considered taxable income. This means you may be required to pay income tax on the benefits you receive. However, specific exceptions and deductions can reduce your tax liability associated with disability benefits.

Non-Taxable Disability Benefits

Certain disability benefits, such as those from the Canada Pension Plan or specific private policies, may be non-taxable. Understanding the tax treatment of your benefits is critical for effective financial planning.

Tax Credits and Deductions

The Canadian government offers a range of tax credits and deductions for individuals with disabilities. These incentives can help offset the financial impact of disability and reduce your overall tax burden.

Special Considerations for Self-Employed Individuals

Next, we will go over the exemptions and special considerations self-employed individuals benefit from.

Unique Challenges Faced by the Self-Employed

Self-employed individuals encounter distinct challenges when it comes to disability insurance in Canada. Unlike employees with group policies, the self-employed must proactively secure their own coverage.

Disability Insurance Options for Self-Employed Canadians

Self-employed individuals can opt for individual disability insurance policies or explore association-based group plans. Understanding the available options and considering the unique needs of your business is essential when considering disability insurance in Canada.

Frequently Asked Questions about Disability Insurance in Canada

Lastly, we have provided answers to some of the most asked questions regarding the subject of disability insurance in Canada.

Can I Have Multiple Disability Insurance Policies?

Yes, you can have multiple disability insurance policies, but there are limitations on the total benefit amount you can receive. Combining policies can provide comprehensive coverage.

Is Disability Insurance Mandatory in Canada?

Disability insurance in Canada is not mandatory, but it is highly recommended to protect your financial well-being.

How Long Does the Claims Process Take?

The duration of the claims process can vary but typically takes several weeks to a few months. It may be longer if there are complications or disputes.

What Happens If I Return to Work While on Disability?

If you return to work while receiving disability benefits, you may still be eligible for partial benefits. This encourages individuals to attempt a return to the workforce gradually.

Case Studies: Real-Life Experiences

Additionally, real case studies are analyzed and mentioned for you to take inspiration from and successfully claim your disability insurance in Canada.

Success Stories of Disability Insurance Beneficiaries

In this section, we will share success stories of individuals who have benefited from disability insurance in Canada. These stories highlight the positive impact it had on their lives and finances.

Lessons Learned from Challenging Disability Insurance Cases

This section explores lessons learned from individuals who faced difficulties with their disability insurance policies, helping readers avoid common pitfalls and navigate the system more effectively.

Conclusion: Securing Your Financial Future

In conclusion, disability insurance in Canada is not just another insurance product; it is a vital safeguard for your financial future in Canada. Understanding the types of disability insurance, the eligibility criteria, benefits, and available government programs empowers individuals to make informed decisions.

Whether you’re an employee, self-employed, or a business owner, disability insurance in Canada ensures you can weather financial storms, maintaining financial stability during difficult times. It’s a critical component of comprehensive financial planning that provides peace of mind and financial security when you need it most.