Retirement Income in Canada: A Simple Guide to Saving and Spending After Work!

Retirement is a significant milestone in one’s life, representing the culmination of years of hard work and financial planning. In Canada, like many other developed nations, ensuring a secure and comfortable retirement is a top priority for individuals as well as the government. This article delves into the intricacies of retirement income in Canada, aiming to provide a comprehensive understanding of its purpose, importance, the Canadian retirement system, and key considerations for planning retirement income.

Key takeaways

- Retirement income in Canada ensures financial security, a comfortable lifestyle, and covers expenses in later years.

- Canadian Retirement System combines government programs, workplace plans, RRSPs, and TFSAs for holistic retirement income.

- CPP is a mandatory savings program providing financial security during retirement, with eligibility based on age, contributions, and residency.

- Personal savings and investment are crucial for a comfortable retirement. Options include 401(k), IRA, stocks, bonds, real estate, and mutual funds.

- Set goals, diversify investments, understand taxes, evaluate government benefits, and stay adaptable, because these are some key planning factors.

Table of Contents

Why Retirement Income Matters

Retirement income in Canada is crucial for maintaining financial security in your later years. It ensures a comfortable lifestyle and covers expenses, making proper planning essential.

- Living Comfortably: Retirement income in Canada is all about enjoying a comfortable life after years of hard work.

- Enjoying Life: It allows Canadians to savor the fruits of their labor, pursue hobbies, and spend time with loved ones.

- Financial Security: Having enough retirement income in Canada is essential to avoid financial struggles and maintain a good quality of life.

The Bigger Picture

Understanding the bigger picture involves gaining a holistic view of a situation, considering long-term implications, and analyzing broader impacts to make informed decisions.

- Economic Stability: Retirement income in Canada isn’t just about individuals; it’s crucial for Canada’s overall economic stability.

- Reducing Burden: It ensures that retirees can support themselves without relying heavily on government assistance.

- Supporting the Future: A robust retirement system means younger generations can focus on their own financial goals without worrying about taking care of their elders.

Overview of the Canadian Retirement System

Canada’s retirement system is a multi-faceted framework designed to provide financial security to retirees. It combines government-sponsored programs, workplace pension plans, and personal savings to create a holistic approach to retirement income in Canada. The cornerstones of the Canadian retirement system include:

- The Canada Pension Plan (CPP): A national social insurance program that provides a basic level of income security to retirees and their survivors.

- Old Age Security (OAS): A federal government program that offers financial assistance to seniors, with the OAS pension being a key component.

- Employer Pension Plans: Many Canadians have access to workplace pension plans, which contribute significantly to their retirement income in Canada.

- Registered Retirement Savings Plans (RRSPs): Tax-advantaged personal savings accounts that allow individuals to save for retirement.

- Tax-Free Savings Accounts (TFSAs): Another tax-advantaged savings vehicle that can be used for retirement or other financial goals.

Key Considerations for Planning Retirement Income in Canada

Planning for retirement income is a complex endeavor that requires careful consideration of various factors. Canadians must navigate investment strategies, taxation, retirement age, and the evolving economic landscape. Some of the key considerations for effective retirement income in Canada include:

- Setting Retirement Goals: Determining the lifestyle you want in retirement and estimating the expenses associated with it.

- Diversifying Investments: Creating a balanced portfolio that can generate income and mitigate risk.

- Understanding Tax Implications: Being aware of the tax consequences of different income sources and planning to minimize tax liabilities.

- Evaluating Government Benefits: Knowing how CPP, OAS, and other government programs fit into your retirement income plan.

- Adapting to Changing Circumstances: Being flexible and adjusting your retirement income strategy as your circumstances evolve.

Canada Pension Plan (CPP)

Canada Pension Plan (CPP) is a crucial pillar of Canada’s social security system, providing financial support to eligible Canadians during their retirement years. Understanding the CPP, its eligibility criteria, benefits calculation, age of eligibility, and recent changes is essential for anyone planning their retirement in Canada.

Explanation of the CPP and its Significance

- CPP is a government-administered pension plan for retirement income in Canada.

- Mandatory savings program for Canadian workers and employers.

- Aims to provide financial security and reduce senior poverty.

Eligibility Criteria and Contribution Requirements

- Eligibility based on age, contributions, and residency.

- Must have made CPP contributions for at least 3 out of 12 months in the base year.

- Both employees and self-employed individuals contribute.

Calculation of CPP Benefits

- Benefits calculated from contributions and contributory period.

- Contributory period typically from age 18 to 65 or until receiving benefits.

- Formula averages contributory earnings adjusted for inflation.

Age of Eligibility and Early/Late Retirement Options

- Standard eligibility age is 65.

- Early retirement possible at age 60 with reduced monthly benefits.

- Delayed retirement until age 70 increases monthly benefits.

Enhancements and Recent Changes to the CPP

- CPP Enhancement started in 2019.

- Phased-in expansion of CPP contributions and benefits.

- Increases future retirees’ replacement rates and financial security.

Old Age Security (OAS)

Old Age Security (OAS) is a government program providing financial assistance to seniors in Canada. It ensures a basic level of income for eligible retirees.

Overview of OAS and its Role in Retirement Income in Canada

- OAS is a crucial part of Canada’s retirement income system.

- It provides financial support to seniors aged 65 and older.

- OAS ensures that older Canadians have a basic income for essential expenses during retirement.

Eligibility Requirements for OAS Benefits

- Age: You must be at least 65 years old.

- Citizenship/Residency: You must be a Canadian citizen or legal resident when applying.

- Residence: You need a specific number of years of residence in Canada since age 18.

Special provisions exist for those with unique circumstances.

OAS Enhancements and Recent Developments

- The government reviews and updates the OAS program periodically.

- Potential enhancements may include increasing benefit amounts and changing eligibility criteria.

- Stay informed about recent developments through official government sources and financial experts.

Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement (GIS) is a government program that provides financial assistance to low-income seniors in Canada. It is designed to supplement their income and improve their overall financial well-being.

Introduction to GIS and its Purpose

The Guaranteed Income Supplement (GIS) is a crucial component of Canada’s social security system designed to provide additional financial support to low-income seniors. GIS is administered by the federal government and complements the Old Age Security (OAS) pension and the Canada Pension Plan (CPP) to ensure that eligible seniors receive a minimum level of income to meet their basic needs.

The program’s primary purpose is to alleviate poverty among elderly Canadians and enhance their quality of life during retirement.

Eligibility Criteria for GIS Benefits

To qualify for GIS benefits, seniors must meet specific eligibility criteria. These criteria include:

- Age: Applicants must be 65 years of age or older.

- Residency: Seniors must be legal residents of Canada and have lived in the country for at least 10 years after turning 18. There are exceptions for those who have lived in countries with which Canada has a social security agreement.

- Income: GIS benefits are income-tested, meaning the amount you receive depends on your annual income. The lower your income, the higher your GIS entitlement. To be eligible for GIS, your income must fall below a certain threshold set by the government.

- Calculation and Payment of GIS: The calculation of GIS benefits is based on an individual’s marital status and annual income. Generally, GIS payments are higher for single seniors or those whose spouses or common-law partners do not receive OAS or GIS benefits.

The government reviews income data from the previous year to determine GIS entitlement, and payments are made on a monthly basis. It’s essential to keep the government updated on your income and marital status, as changes can affect your GIS payments.

- Interaction between GIS and Other Retirement Income Sources: GIS is designed to provide additional support to those with limited income in retirement. However, it’s important to understand how GIS interacts with other retirement income sources.

The amount of GIS you receive may be affected by your OAS pension, CPP benefits, and other sources of income. As your income increases, your GIS entitlement may decrease. Therefore, it’s essential to plan your retirement income carefully to maximize your financial security while ensuring you receive the benefits you are entitled to.

Registered Retirement Savings Plans (RRSPs)

Registered Retirement Savings Plans (RRSPs) are tax-advantaged accounts in Canada designed to help individuals save for retirement. Contributions to RRSPs are tax-deductible, and the funds can be invested in various financial instruments.

What’s an RRSP?

An RRSP, or Registered Retirement Savings Plan, is like a special savings account that helps Canadians save for their retirement.

Saving for Retirement

Imagine you want to save money for when you stop working. An RRSP is one way to do it. It’s like a piggy bank for your retirement.

How Much Can You Put In?

You can add money to your RRSP, but there’s a limit. It’s usually a percentage of the money you earned the year before, up to a certain maximum amount. This limit changes every year, so it’s good to check what it is.

Save on Taxes

The cool thing about RRSPs is that when you put money in, you pay less income tax. So, if you earned $50,000 but put $5,000 into your RRSP, you’d only pay taxes on $45,000. This can mean less money to the taxman and maybe even a tax refund for you!

Taking Money Out

You can’t keep your money in your RRSP forever. By the time you’re 71, you have to start taking it out. You can choose to get a little bit every year, and that money counts as income, so you’ll pay taxes on it. It’s like getting a regular paycheck in retirement.

Different Options

When you turn 71, you have some choices. You can turn your RRSP into something called a RRIF or use it to buy an annuity. These are like special retirement accounts that pay you regularly.

If you like managing your money, you can also change your RRSP into a Locked-In Retirement Account (LIRA) or a Life Income Fund (LIF). These give you more control over your retirement savings.

Unlocking the Power of Your Tax-Free Savings Account (TFSA) for Retirement

Are you ready to supercharge your retirement savings? Look no further than the Tax-Free Savings Account, or TFSA! In this article, we’ll break down everything you need to know about TFSAs and how they can be your best friend when it comes to preparing for retirement. Let’s dive right in!

Overview of TFSAs and Their Role in Retirement Planning

Think of a TFSA as your financial Swiss Army knife. It’s a special account that lets you save and invest money without paying a dime in taxes on your investment gains. That means more money in your pocket when you retire! Plus, you can use it for all sorts of financial goals, including buying a home or taking a dream vacation. It’s flexible and versatile, just like you!

Contribution Limits and Carry-Over Room

Now, let’s talk numbers. The government sets a yearly contribution limit for TFSAs. But here’s the kicker: if you don’t use up your entire contribution limit in a year, you can carry over that unused room to the next year. It’s like a second chance to save even more. We’ll show you how to maximize your contributions without breaking a sweat.

Tax Advantages and Benefits of TFSAs

The magic of TFSAs lies in the word “tax-free.” Unlike some other accounts, you won’t pay tax on any interest, dividends, or capital gains you earn within your TFSA. It’s like having a money-growing tree in your backyard, and the best part is, the government won’t come knocking for a share!

Withdrawal Rules and Considerations for Retirement Income in Canada

Retirement isn’t just about saving; it’s also about spending wisely. TFSAs offer unparalleled flexibility. You can withdraw your money whenever you want, for whatever you want, without penalties. Plus, any money you take out is still tax-free! We’ll guide you on how to strategically use your TFSA for retirement income in Canada.

Comparison to Other Retirement Savings Options

Curious how TFSAs stack up against other retirement savings options like RRSPs or pension plans? We’ll give you the lowdown on the pros and cons of each so you can make an informed decision. Spoiler alert: TFSAs offer unique advantages that might just make them your top choice.

In a nutshell, your TFSA is like a financial superhero in your retirement planning toolkit. It’s easy to use, offers incredible tax benefits, and can help you reach your retirement goals faster. So, whether you’re just starting your career or nearing retirement, it’s never too late to harness the power of your TFSA. Let’s make your retirement dreams come true!

Employer Pension Plans: Your Roadmap to a Comfortable Retirement

When it comes to securing your financial future, employer-sponsored pension plans can be your best friend. These plans are like a golden ticket to a worry-free retirement, offering various benefits and features tailored to your needs. In this article, we’ll walk you through the world of employer pension plans in a user-friendly way, covering everything from the different types of plans to what you should consider before signing up.

Types of Employer-Sponsored Pension Plans

There are mainly two types of employer-sponsored pension plans: defined benefit and defined contribution.

- Defined Benefit Plans: Imagine these as the traditional, reliable plans. They promise you a fixed amount of money in retirement, usually based on your salary and years of service. It’s like having a steady paycheck even after you’ve stopped working.

- Defined Contribution Plans: These are more like investment accounts. You and your employer contribute to this account regularly, and the final amount you get in retirement depends on how well your investments perform. Think of it as your retirement savings adventure!

The Importance of Employer Pension Plans in Retirement Income in Canada

Employer pension plans are your safety net in retirement. Social Security alone might not cover all your expenses, so these plans are crucial. They provide you with a stable income stream, making sure your retirement years are comfortable and stress-free.

Eligibility Criteria and Participation Requirements

Not everyone gets access to these plans right away. Eligibility criteria can vary, but typically you need to work for your employer for a certain period before you can join. Once you meet these criteria, participating is usually a breeze – just sign up and start reaping the benefits.

Vesting, Contribution Matching, and Other Plan Features

Now, let’s talk perks! Some plans come with vesting schedules, which determine when you fully own your employer’s contributions. Also, keep an eye out for contribution matching. Your employer might add free money to your retirement savings, matching your contributions up to a certain percentage.

Other plan features can include investment options, like stocks or bonds, and the ability to change your contributions as your life circumstances change.

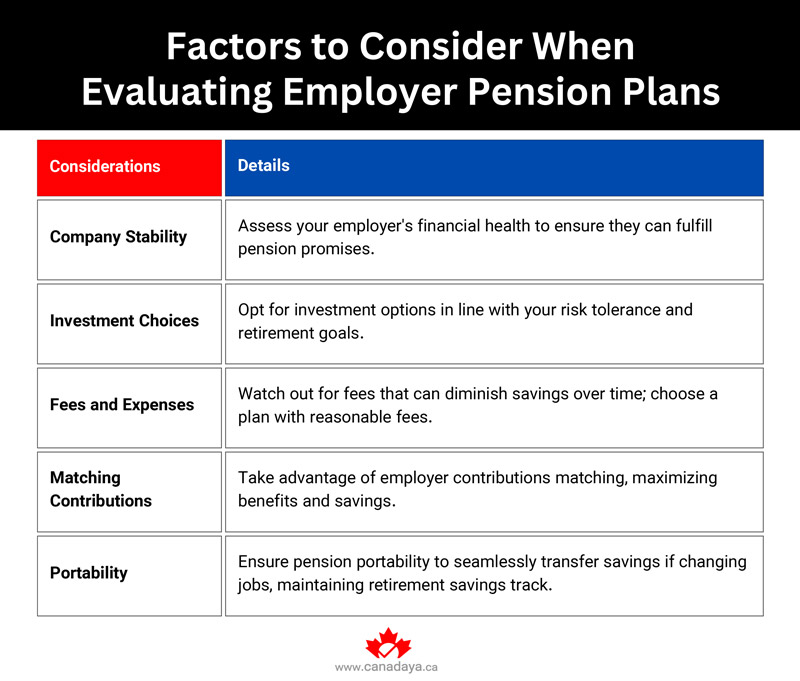

Factors to Consider When Evaluating Employer Pension Plans

Before committing to a plan, there are a few things to think about:

Personal Savings and Investments: Building a Bright Retirement Future

Planning for your retirement may seem like a distant goal, but it’s never too early to start. Whether you’re in your 20s, 40s, or 60s, personal savings and investments play a vital role in securing a comfortable retirement. In this article, we’ll break down the key elements you need to know in a friendly, easy-to-understand way.

The Importance of Personal Savings and Investments for Retirement Income in Canada

Imagine your retirement years as a long, relaxing vacation. To fund this adventure, you need money, and that’s where personal savings and investments come into play. Social Security alone might not be enough to maintain your desired lifestyle. Saving and investing early means you won’t have to work forever and can enjoy your golden years without financial stress.

Investment Options and Considerations for Retirement Savings

There’s no one-size-fits-all approach to retirement savings. You have various options to consider:

- 401(k) and IRA Accounts: These are tax-advantaged retirement accounts where you can invest a portion of your paycheck. Your money grows over time, and you may even receive employer contributions.

- Stocks and Bonds: Investing in stocks and bonds can provide potential for long-term growth. Stocks offer higher returns with more risk, while bonds are generally safer but offer lower returns.

- Real Estate: Owning property can be a smart investment for both rental income and potential appreciation in value.

- Mutual Funds: These are diversified investment vehicles that pool money from multiple investors to buy a mix of stocks, bonds, or other assets.

Strategies for Building a Retirement Nest Egg

Building a retirement nest egg is like planting a tree. The earlier you start, the better it will grow. Here are some strategies:

- Start Early: Even small contributions add up over time thanks to compounding interest.

- Set Goals: Determine how much you’ll need in retirement and create a savings plan to reach that goal.

- Automate Savings: Set up automatic transfers to your retirement accounts, so you don’t have to think about it.

- Diversify Investments: Spread your investments across different asset classes to reduce risk.

Balancing Risk and Return in Retirement Investments

As you get closer to retirement, it’s crucial to balance risk and return. While high-risk investments can yield big returns, they can also lead to significant losses. Consider shifting your portfolio towards more conservative investments, like bonds, to protect your nest egg as retirement approaches.

Maximizing Returns and Managing Withdrawals in Retirement

Once you retire, you’ll need a strategy for managing your savings. Here are some tips:

- Create a Withdrawal Plan: Determine how much you can safely withdraw each year to ensure your money lasts throughout retirement.

- Stay Informed: Keep an eye on your investments and adjust your strategy as needed.

- Seek Professional Advice: Consider consulting a financial advisor to help you navigate the complexities of retirement finances.

A User-Friendly Guide to Financial Planning for Retirement

Planning for your retirement is like preparing for a grand adventure. Just like you wouldn’t set off on a journey without a map and some guidance, you shouldn’t retire without a financial plan in place. In this article, we’ll break down the key aspects of financial planning for retirement in a way that’s easy to understand and act upon.

The Role of Comprehensive Financial Planning in Retirement Income in Canada

Imagine your retirement as a puzzle, and each piece represents a financial aspect of your life. Comprehensive financial planning is like putting all those pieces together to create a beautiful picture.

It’s about looking at your savings, investments, pensions, and other assets to ensure they fit together seamlessly to provide you with the income you need during retirement.

Working with Financial Advisors or Retirement Planners

- Think of a financial advisor or retirement planner as your trusted travel guide on this retirement journey.

- They have the expertise to help you navigate the complexities of retirement planning.

- They can help you make informed decisions about your investments, insurance, and other financial matters, ensuring you’re on the right path towards your retirement goals.

Retirement Income in Canada Projections and Budgeting

- Budgeting for retirement is like planning your daily activities during your vacation.

- You need to estimate how much money you’ll have and how you’ll spend it.

- Retirement income projections help you understand your financial picture in retirement.

- It’s about figuring out how much you’ll receive from your pension, Social Security, and other sources and then creating a budget to make sure you can enjoy your retirement to the fullest.

Strategies for Maximizing Retirement Income and Minimizing Risks

- Just like you’d look for ways to save money on your trip, you should explore strategies to maximize your retirement income in Canada.

- This includes optimizing your investments, managing taxes, and considering income-generating options like annuities.

- It’s also crucial to protect your retirement nest egg by managing risks, such as market volatility or unexpected health expenses.

Regular Reviews and Adjustments to Retirement Plans

- Retirement planning is not a “set it and forget it” process.

- Think of it as constantly checking your travel itinerary and making adjustments as needed.

- Your financial situation and goals may change over time, so it’s important to review your retirement plan regularly.

- If necessary, make adjustments to ensure you’re still on track to reach your retirement dreams

Conclusion

In conclusion, planning for retirement is a journey that deserves careful consideration and preparation. Just as you would plan every detail of a memorable vacation, you should plan every aspect of your retirement to ensure it’s a fulfilling and stress-free chapter of your life.

Comprehensive financial planning, with the guidance of a trusted advisor, is the map to a secure retirement income in Canada.

Remember, retirement income in Canada isn’t just about numbers; it’s about the quality of life you’ll enjoy in your golden years. It’s about savoring the fruits of your labor, pursuing your passions, and spending cherished moments with loved ones. By setting clear retirement goals, diversifying your investments, understanding tax implications, and staying flexible in the face of change, you can make sure your retirement is everything you’ve dreamed of.